Welcome to our Sarasota Manatee County real estate update, where we cut through sensational headlines to focus on local data. Despite national fears, our market shows a resilient 3% increase in closed sales year over year, with stable cash sales and a healthy median price appreciation of 2.7%. As new listings surge and time to contract remains stable at around 44 days, our balanced inventory of approximately 4.6 months ensures a competitive yet steady environment for buyers and sellers alike.

Debunking Headline Hype with Sarasota Manatee County Data

When it comes to real estate, you might have encountered alarming headlines proclaiming a market crash. Yet, it's crucial to focus on hyperlocal data for a true picture. National news tends to highlight sensational figures from isolated areas or tiny surveys, which might not reflect broader trends.

In Sarasota Manatee County, the reality is more positive. Contrary to the doom and gloom, we've actually seen a 3% increase in closed sales year over year. This growth is a healthy sign for our local market.

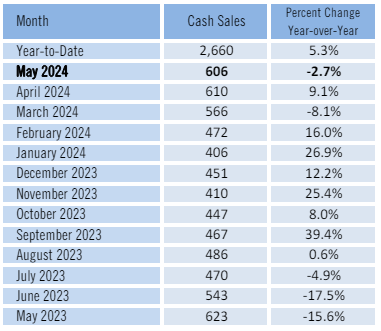

Cash sales have slightly dipped but remain stable within the 36% to 41% range, consistent with the past five years. This steadiness indicates that the market is on firm ground, moving towards a balanced state.

Update on Median Sales Prices and Market Growth

Next, we examined the median sales price, a key indicator of market appreciation. Compared to last year, the median price has risen by 2.7%, signaling a positive trend. Month-over-month, however, the price showed a minor decline, dropping from $535,000 last month to $527,000. This figure has experienced some fluctuations: it was $500,000 in March, climbed to $535,000, and now rests at $527,000.

While these month-to-month changes may seem concerning, the year-over-year increase falls within the ideal range of 2% to 4%, which is generally considered a sign of healthy market growth. A consistent appreciation within this range reflects stability and suggests that the market is functioning well. If this trend continues, it indicates a smooth and steady increase in property values, which is beneficial for both buyers and sellers in the long run. Monitoring these patterns helps us understand the market dynamics better and plan accordingly for future investments.

Insights into Price Realization and Market Resilience through List Price Performance

Next, let's delve into the percentage of the original list price received. This metric indicates the proportion of the listing price that sellers actually achieve in a sale. Presently, if you list your home for $100,000, you can anticipate receiving around 95% of that price. This represents a decrease of about 1% compared to this time last year, but the change is more modest when viewed month over month, with only a slight drop of 0.2%. Over the past year, this figure has consistently fluctuated within the low to high 95% range.

This trend underscores a key aspect of the current market: accurately priced homes are still receiving strong, prompt offers. If a property is priced correctly from the beginning, it often sells quickly and close to the listing price. Conversely, homes that linger on the market tend to be those that were initially overvalued. Sellers who attempt to test the market with higher prices often find themselves adjusting downward as the market responds unfavorably to inflated valuations.

The stability in the percentage of the original list price received suggests that, while there is a slight decline, the market remains relatively resilient. This metric is a valuable indicator for both buyers and sellers, reflecting the importance of strategic pricing in achieving optimal sale outcomes. For sellers, it highlights the necessity of setting realistic expectations and aligning listing prices with current market conditions to attract competitive offers and facilitate smoother transactions.

Contract Time and Inventory Insights in a Growing Market

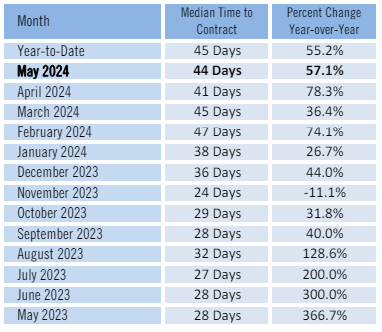

Now let's talk about the time to contract, which we typically review on a month-to-month basis due to the shifting nature of the market over the past year. The median time to contract currently stands at 44 days, up slightly from 41 days the previous month but down from earlier months. This figure has been relatively stable, hovering consistently between 40 and 45 days.

Looking ahead to next month, new pending sales have increased by about 0.5% compared to the same period last year. This uptick suggests a potentially strong performance for the upcoming month, with solid activity anticipated once the June numbers are finalized at the end of July.

Interestingly, new listings have surged by 18% from this time last year, indicating a rise in seller activity. Around this time last year, the market saw some hesitation due to rising interest rates, which created uncertainty among sellers. As conditions have stabilized, more homeowners are confident about listing their properties again. This increase in listings is beneficial for both buyers and sellers: buyers gain more choices, while sellers must price their homes more competitively, contributing to a balanced market environment.

Turning to the months' supply of inventory, we remain in a balanced market. Last month, there were 5,755 homes on the market, and this month that number increased slightly to 5,809. This minor rise does not significantly impact the overall supply, which remains balanced. We classify the market as balanced when the months' supply falls between 3 and 5 months. At approximately 4.6 months of supply, the current market is in equilibrium. If no new listings were added, it would take about 4.5 months to sell all existing homes. This balance suggests that the market is functioning well, with a healthy interplay between supply and demand.

Market Highlights: Sales Trends and What's Up with Distressed Properties

When examining closed sales by price range, the majority of transactions in Sarasota Manatee County fall within the $500,000 to $1 million bracket. This segment is currently the market's "sweet spot," accounting for roughly 60% of all sales. Consequently, this range also houses the bulk of available inventory, indicating strong buyer interest and a robust market presence in this price tier.

Regarding distressed properties, such as foreclosures and short sales, there are common questions about whether these will surge. However, unlike the financial crisis of 2007-2008, current market conditions suggest otherwise. Most homeowners who purchased in recent years enjoy significant equity and have benefited from historically low interest rates. This is in stark contrast to the higher rates and minimal down payments typical during the previous crisis, which left many homeowners with negative equity and limited options.

In fact, foreclosure sales have decreased from last year, and short sales remain minimal, averaging just one or two per month over the past three to four years. The current situation is markedly different, with banks having learned from past mistakes. Even when foreclosure sales occur, these homes are often rehabilitated and updated, making them competitive in the market rather than the distressed properties of previous years.

As we navigate through this election year, it's essential to monitor developments in fiscal and monetary policy. The Federal Reserve's decisions on interest rates will play a significant role in shaping the market's trajectory in the second half of the year. A potential rate cut could offer some relief by making mortgage rates more affordable, albeit with a modest impact on overall housing affordability.

In summary, Sarasota Manatee County's real estate market is holding steady with encouraging sales growth, stable prices, and a balanced inventory. Whether you're considering buying or selling, keeping up with local trends will help you make informed decisions in today's dynamic environment. Stay informed and seize the opportunities this market has to offer!

For those with questions or seeking more detailed insights, feel free to reach out via my contact information below, or get in touch with your House Match agent. We'll continue to keep you updated as the market evolves. Thank you, and see you next month!

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 2]](https://images.squarespace-cdn.com/content/v1/5ff61943aa444278595b8689/1764095715906-KQ0RGMRPOU8Q95DKXZH8/banner.jpg?format=200w)

![Your Home Buyer Wants To Extend The Closing Date—What Now? [PART 1]](https://images.squarespace-cdn.com/content/v1/5ff61943aa444278595b8689/1763491022538-5L6YSOVFYV04D5CPCGH0/banner.jpg?format=200w)